Car Insurance: Quote Consideration Factors

CarsInsuranceTop Five September 14, 2020 Kristian Wilson

How do you know if you found the right car insurance company and are getting the best quote ?

Before you make a decision on which company to buy car insurance with, you should be aware of the factors the insurance companies consider when they give you a quote:

The Devil is in the details:

There are over 600 car insurance companies across the country. Factors including what you drive, how you drive, your credit score and where you live are all factored into your quote. Here are some of the biggest considerations:

- Your Age: If you’re still in your teens, bad news- you’re going to have the most expensive car insurance in every state. Once you have a few years of driving experience- premiums typically go down.

- Your Gender: Women tend to pay cheaper insurance rates versus men. The reason? Research has found that men are more likely to speed, not wear seatbelts, cause accidents and drive under the influence.

- Owning vs. Renting: Individuals who rent can pay as much as 40% more for their car insurance versus those who own their property.

- Your Marital Status: If you’re single, chances are good that your rates will be higher versus those that are married. Statistics show that married couples are involved in fewer car accidents versus those that are single.

- What you Drive: The make and model of your car 🚗 weigh heavily for insurance premium considerations. Different cars have different probability for theft, accidents and associated claims.

- Your Record: Your driving record is a big deal when it comes to insurance. Incidents of speeding, DUIs, and previous accidents are very important to the company that ends up insuring you. Small violations can lead to be increases in your insurance.

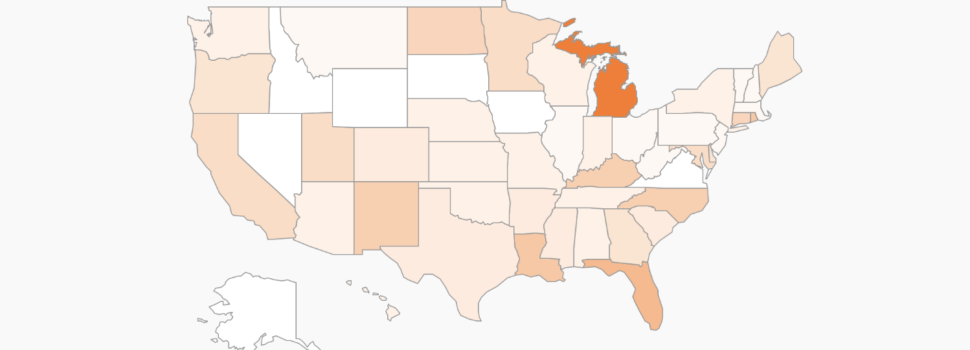

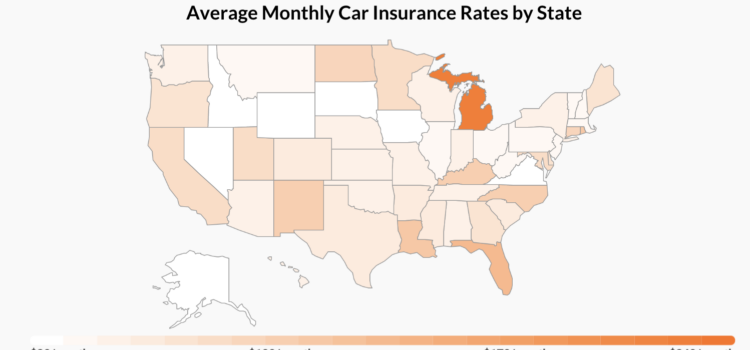

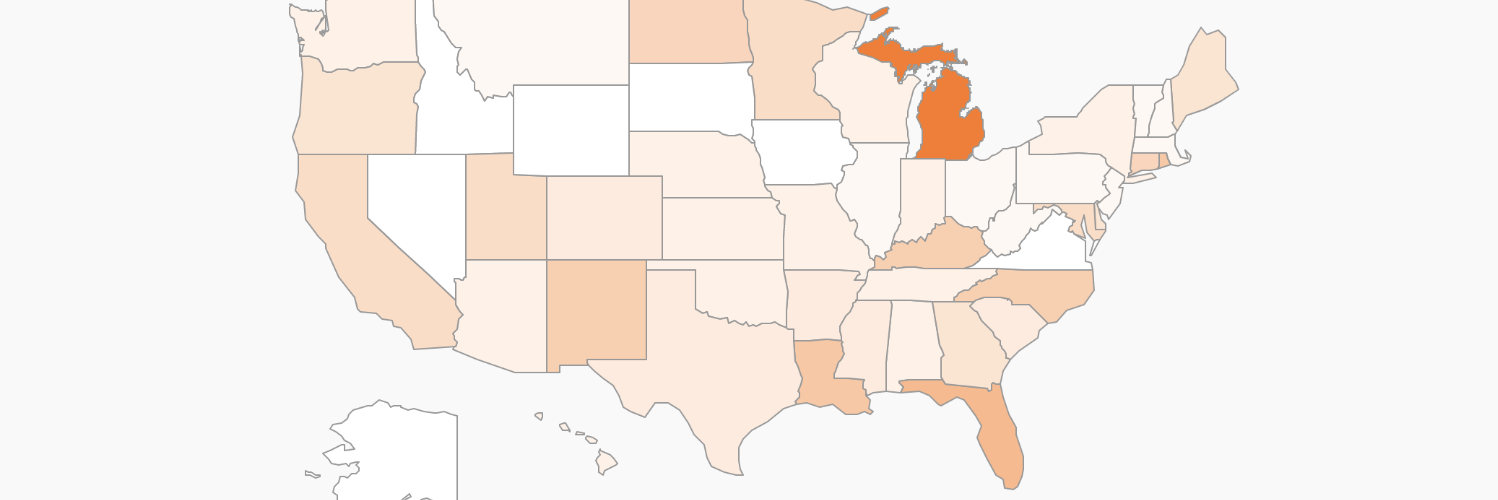

If you have moved recently, you should be aware of the cheapest and most expensive states for auto insurance:

Top 5 most expensive states for car insurance

- Michigan

- Florida

- Lousiana

- Rhode Island

- New Jersey

Top 5 least expensive states for car insurance

- South Dakota

- Wyoming

- Iowa

- Alaska

- North Dakota

Related Posts

How to Reduce Your Car Insurance Rates for 2021

Even if you’re not driving as much anymore, you are required to have car insurance. There are many options out there for the price conscious consumer. Today we’re taking a look at some of the best car insurance companies for the money in 2020. We’re looking at a combination of…

Searching to Buy a MiniVan?

Fall is here, and many car dealerships are pushing sales. With this in mind, our guides have picked out a few of the best 2020 minivans on the market for you and your family to hit the road in style and comfort. Check out our review below: Honda Odyssey Three…

Great Deals on Luxury SUVs: 2020 Review

Our lives have been deeply impacted and overwhelmed by COVID-19, also known as the Coronavirus. Restaurants, bars, movie theaters, and thousands of other businesses have been affected. So, what is going on with car dealerships and what are the best car deals? 2020 Audi A4 Audi virtual cockpit For 2020,…