Compare Top Auto Insurance Companies-Get Better Insurance Today

FinanceHow ToInsuranceReviewsTop FivexPick February 3, 2021 Kristian Wilson

Buying a new vehicle is everyone’s dream and an exciting experience. However, vehicles are expensive, and consumers need to protect their investment with car insurance. The insurance covers your car in case of an accident and protects the driver from certain liabilities. When searching for a reliable car insurance company, look at the coverage options, price of policies, financial strength, and customer service reviews before settling on a company. In this article, we have detailed information that will make the process easier.

Most people are currently working from home and are not driving that much due to COVID-19. However, it is still essential to have car insurance when you drive. Car owners who are paying for a financed vehicle also need to have auto insurance.

Before we came up with the list below of the best car insurance companies, we considered factors like claims satisfaction, customer compliant scores, customer satisfaction, and claims settlement. We also turned to industry experts and Consumer Reports to get accurate and quality car insurance reviews.

Top Auto Insurance Companies:

The insurance market is flooded with different car insurance companies. However, we have picked quality car insurance companies in the market. Not all car insurance companies offer the same policy package to everyone. Therefore, to determine the best insurance provider that can take care of your needs, it is vital to consider your age, credit rating, and budget.

#1 General Auto Insurance

General auto insurance is our top pick for high-risk drivers looking for quality car insurance. The company does not shy away from young drivers or those who have been involved in multiple accidents. For instance, most car insurance companies avoid providing coverage to drivers that need an SR-22. The General auto insurance covers drivers who require SR-22 by including the form in their policy. That gives the driver a chance to file the SR-22 form in a brief period.

Also, the insurance company has a mobile application as well as an online portal for customers to manage their insurance policies easily. The online portal offers users basic functionalities such as viewing policy details, receiving ID cards, and making payments. Since the features are not unique, they offer high-risk drivers similar benefits to standard drivers through other quality car insurance companies such as State Farm.

Pros

- Offers car insurance cover to high-risk drivers

- Can file the SR-22 form for drivers who need it

Cons

- Provides few policy options and discounts

- Drivers who are not high-risk will have a better experience with other insurance providers.

#2 Progressive insurance

For drivers interested in the best coverage options, Progressive is the ideal option. The company offers customers an easy platform on their website to choose the available policy within their price range. All you have to do to get the online quote is to enter the amount you are willing to pay for the car insurance, and the company will provide you with a list of policy options available within your budget.

The company has a Name Your Price online tool that makes shopping easier for high-risk drivers. The drivers can use Progressive’s usage-based Snapshot program to redeem their driving record. Snapshot monitors the drivers driving habits and rewards them with discounts when they obey the traffic rules.

Pros:

- Online rate comparison tool

- Custom equipment coverage

- Gap insurance available

Cons:

- Claims handling of below average

- Expensive rates

#3 Amica Mutual

The company has a history of offering excellent coverage and customer service. The insurer offers various policies, including ATV insurance. Amica also offers its customers usual coverages such as uninsured and underinsured motorist, personal injury protection along with excellent addons, including glass cover and roadside assistance.

Pros:

- The best in customer satisfaction

- The best in auto claims satisfaction

- Free lock replacement for lost keys

Cons:

- No discounts

- Few local offices

#4 Allstate

This car insurance company offers quality customer service to motorists in America. The company is ranked among the top car insurance providers in the U.S. However, the company’s policies are more expensive compared to other auto insurance providers. This is because of limited discount offerings. The company offers quality services for what customers pay for.

Pros:

- Easily available

- Mobile app and online tools

- Teen drivers get discounts

Cons:

- Limited discounts

- Limited optional policies

- Its satisfaction rating is below average

#4 USAA insurance

It is the best car insurance company for active military members, veterans, and qualified family members. The company provides quality car insurance coverage to military personnel at reduced rates for low mileage and a 60 percent discount for cars parked during deployment.

USAA provides a detailed portfolio of financial products to qualified members. The products include checking and savings accounts, retirement accounts, and investment products. The car insurance company is ranked among the best insurance companies.

Pros:

- Quality customer service and high claims ratings

- Available nationwide

- Excellent mobile and online tools

Cons:

- Limited to military and veteran families

- To receive a quote, one has to be a member

- Violations of billing-related regulations

#5 Farmers

The company provides standard vehicle insurance, including liability, medical payments, collision, uninsured and underinsured motorist coverages, as well as comprehensive. The company also offers optional coverages, new car replacement, customized equipment, original equipment, and spare parts coverage.

Pros:

- Alternative fuel discounts

- Easy claims process

- Great mobile app

Cons:

- Low claims satisfaction rating

- Low client satisfaction

- No discounts

How to Save on Car Insurance:

1.Consider getting a bundled home-auto insurance policy

As mentioned earlier, during this pandemic period, people are not driving much. Therefore, you can look for an insurer that provides a pay-per-mile or home-auto bundle program. The policies base rates depending on how much you drive and others, depending on how well you drive. The insurance company that offers these policies installs a device in your vehicle that transmits data back to the company. Several car insurance companies, including Allstate, Progressive, and Geico, are among the insurance companies that offer this policy in some states.

2.Avoid having too many car insurance policies.

It is high time you drop collision and comprehensive insurance if you have a clunker. Comprehensive insurance compensates a stolen vehicle, vandalized, damaged by storms, or one that hit an animal. Similarly, collision insurance caters for a vehicle that flips over or crashes into objects or another vehicle.

If the amount you pay for annual coverage plus your deductible is more than your vehicle, drop the two insurance policies. Comprehensive and collision cannot compensate more than the vehicle’s value.

After dropping the two insurance covers, use the money to finance car repairs or use it as a down payment for a better vehicle.

3.Drive safely

Car insurance premiums can go up due to accidents and traffic tickets. Once you are issued a ticket, you may be forced to get it dismissed or have the violation points reduced on your driving record. However, if you avoid a violation on your driving record, you can save a lot of money and time.

4.Ask for discounts

Car insurance companies provide unique techniques to reduce your coverage premium. Request your agent to review possible savings to ensure you get all discounts entitled to you. Several car insurance companies offer discounts to their customers. However, it is vital to compare quotes depending on your situation. Some insurance providers offer many discounts, but that does not mean their policies are cheap.

5.Increase the deductible

When you raise your deductible, you will save money on comprehensive and collision. A deductible is an amount the insurance provider does not cove when compensating for repairs. For instance, if the cost of repair is $3000, and your deductible is $1000, the insurance company will pay $1000. Remember that savings vary by company. Therefore, it is essential to compare quotes with other deductible levels before deciding.

Factors that Insurance Agencies Consider when Quoting a Rate:

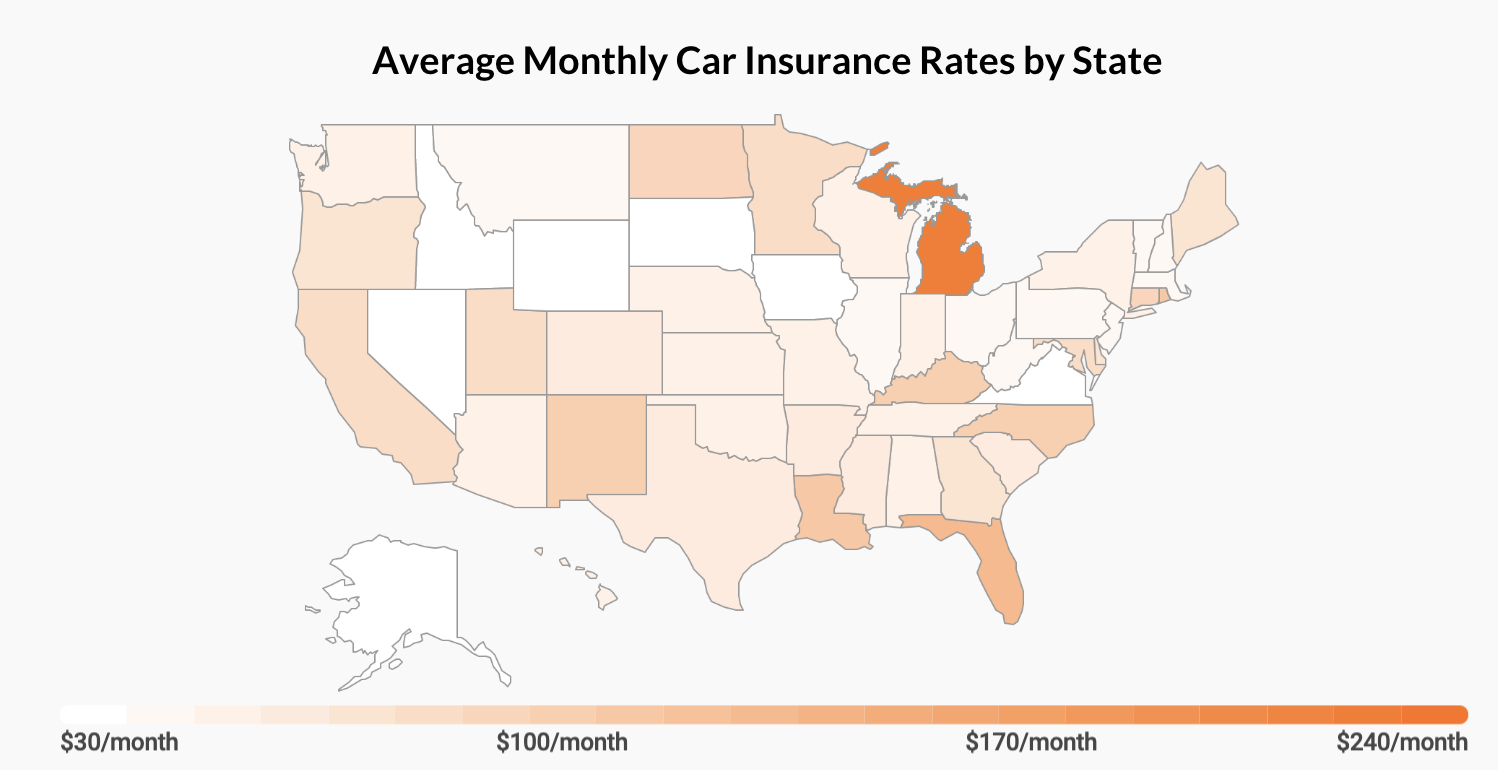

Where you live is the start of base rates. That is why car insurance companies ask for your ZIP code. Accidents and insurance claims are more prevalent for persons who live in urban areas with a high population. Therefore, your rates can be higher than someone who resides in a rural area where accidents are less likely to occur.

Drivers Age

The rates of a young driver are high compared to an older driver. Researchers claim that young drivers are easily distracted and crash a lot. However, different insurance companies decrease the rates at different times. At 25 years, your rates can drop by up to 20 percent.

Researchers from (IIHS) Insurance Institute for Highway Safety claim that drivers between the ages of 30 and 69 have fewer chances of getting involved in accidents. A young driver who maintains a clean record can enjoy relatively flat car insurance rates until considered as a senior driver.

Gender

Since the crash, statistics vary for females and males, some states allow insurance companies to rate gender. According to research, males, mostly young, aggressive drivers, are more likely to crash.

The IIHS reports that men drive more than women and engage in risky driving behavior like not using seat belts, driving when intoxicated, and speeding. The organization also claims that crashes involving male drivers are severe compared to female drivers.

However, that does not mean female drivers pay lower rates than male drivers. Fatality risk reduces with age, not gender. When both women and men get to their 30s, the general auto insurance rates become comparable with most insurance providers for both sexes. Some insurers may also allow males to pay lower rates than females, depending on their data, polices, and research.

As drivers get to their 60s, males pay more than females. That is because researchers claim older men tend to crash more compared to females. However, some states do not allow gender to affect insurance rates, including:

• Michigan

• Pennsylvania

• Massachusetts

• North Carolina

• Montana

• Hawaii

Type of vehicle

The kind of vehicle you drive may also affect your rates. That is because the way one drives these vehicles may differ. If according to the car insurance company, your vehicle’s model tends to crash more than others, or the model has filed more claims, your rates can be higher.

Also, other factors that the insurer may determine from the model of your vehicle include:

• Cost of repair

• Safety tests

• Purchase price

• Theft rate

It is also essential to note that a vehicle that does well on the safety test does not get lower rates. Vehicles’ collision-warning safety features may also receive high rates if the cost of replacing the feature is high. However, a few insurers have started to offer discounts for vehicles with extra safety features.

How Insurance Differs:

ATV Insurance

An all-terrain vehicle (ATV) can be dangerous to the rider and can lead to serious injuries when an accident occurs. Replacing an ATVs can be expensive if severely damaged. Therefore, purchasing an ATV insurance is a wise move.

Most insurance companies offer ATV insurance cover under the motorcycle insurance policy. The same process used to gather an online quote for a motorcycle is the same used for ATVs. The difference is one enters the ATV information.

Motorcycle 🏍 Insurance

A motorcycle may cost less than a vehicle. However, motorcycle insurance is more expensive compared to car insurance. That is because the rider is at a higher risk of getting involved in an accident while riding.

Car 🚗 Insurance

Car insurance may vary between different insurers since they use various rating factors. The companies have different statistical information they consider and claims experience. Also, the company may consider how much it may need to pay your claims during the year.

Boat ⛵️ Insurance

Most insurance companies provide boat insurance, including basic cover for damage or loss, and several additional options. Some insurers can cover the boat owners for common insurance activities and risks. The policy can compensate the boat’s occupants if they get injured. It also provides coverage for damage, theft, or loss. The policy also protects the boat owner from incurring costs after accidental damage to other people’s property.

Commercial 🚛 Vehicle Insurance

The insurance policy covers accidents that occur when you and your staff are using a company vehicle. Both commercial and personal vehicles cater to medical and legal bills related to car accidents. However, commercial vehicle insurance covers different types of cars, complex legal issues, and higher claims. The policy insures all employees in the business. That means that any employee can drive the vehicle if they have a valid driver’s license.

Commercial 🚚 Truck Insurance

The insurance protects trucks in accidents, theft, vandalism, injury to the driver or third party, among other damages. Insurance experts designed commercial truck insurance to meet the driver’s needs, business, and other vehicles.

Related Posts

How to Reduce Your Car Insurance Rates for 2021

Even if you’re not driving as much anymore, you are required to have car insurance. There are many options out there for the price conscious consumer. Today we’re taking a look at some of the best car insurance companies for the money in 2020. We’re looking at a combination of…

Best ATV Destinations in America

All-terrain vehicles (ATVs) provide a massive amount of enjoyment for people of all ages. Make sure you have insurance before you hit the trail! There are some places to take out your quad that are more exciting than others. Fortunately, some of the best ATV destinations are likely right around…

Car Insurance: Quote Consideration Factors

How do you know if you found the right car insurance company and are getting the best quote ? Before you make a decision on which company to buy car insurance with, you should be aware of the factors the insurance companies consider when they give you a quote: The…